Benefits & Value Proposition:

- Reduced Financial Losses: Proactively identify and prevent fraudulent transactions,

minimizing financial losses and protecting your bottom line.

- Enhanced Customer Trust: Safeguard customer accounts and data, fostering trust and

loyalty.

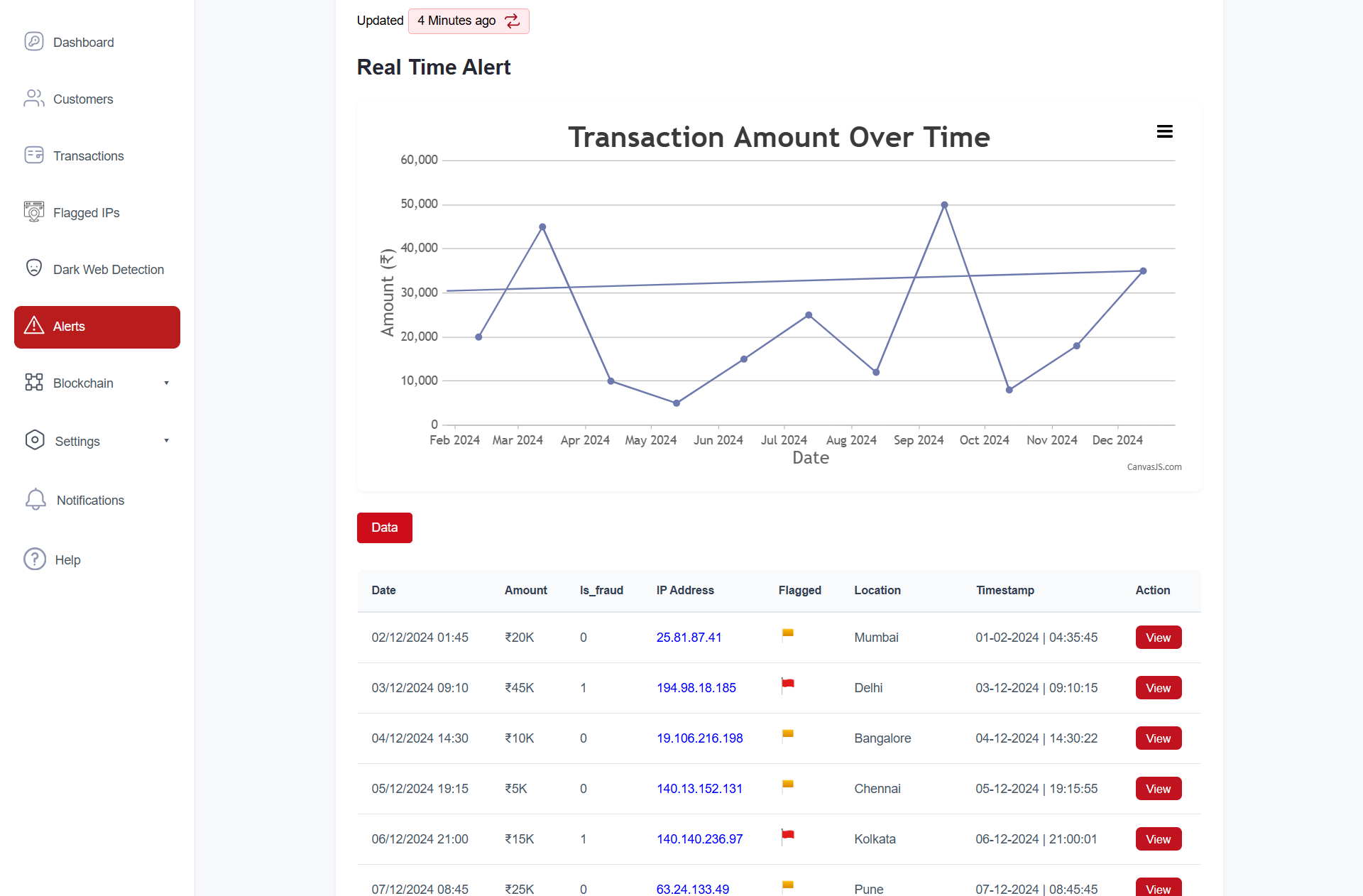

- Improved Fraud Detection Accuracy: Leverage the power of AI and machine learning to

detect any fraudulent transactions.

- Streamlined Fraud Prevention: Automate the fraud detection process, freeing up valuable

time and resources for other critical tasks.

- Compliance with Industry Regulations: Ensure compliance with relevant industry

regulations and standards.

- Cost-Effective Solution: Benefit from a highly effective fraud prevention solution at a

competitive price point.

Innosec Analytics' Payment Fraud Prediction Model empowers small banking institutions and e-commerce

businesses to proactively address payment fraud, and thereby increase the trust of the customers. By

leveraging the power of AWS Fraud Detector and incorporating AI-driven analysis, our solution provides a

robust, accurate, and cost-effective defense against the ever-evolving threat of online fraud. Contact

us today to learn how we can help you safeguard your transactions and secure your business.